- Tesco Resources

- Blog | The science behind the Tesco Media & Insight Platform

Blog.

The science behind the Tesco Media & Insight Platform

“Helping brands and agencies succeed by putting the customer first.” That’s the promise that the Tesco Media & Insight Platform was founded on, and it’s one that sits proudly on our homepage. What does that mean in practice, though? And – perhaps more importantly – how exactly is that promise made possible?

To answer those questions, we need to talk about the subject of customer data science; it’s for good reason that “insight” has equal billing alongside “media” in the name of our platform. Much as it might offer unrivalled levels of reach and scale, after all, that would mean very little if the platform didn’t also give brands and agencies the ability to find and engage with customers in a focused and targeted way.

At the same time, those two subjects – scale and insight – are heavily linked. Reaching the “right” audiences also means identifying which customers are the most relevant, not just in terms of your brand and products, but your objectives, too. Scale is important in that respect, because the larger the audience you have at your disposal, the more likely it is that you can find the distinct groups you need.

It's here that the Tesco Clubcard comes into play. Providing insight into more than 20 million customers from across the UK, the Clubcard serves as the country’s largest, most diverse, and most socio-economically representative first-party behavioural dataset. In short, if you want to know how Britain shops for its groceries today – and learn how to shape what Britain buys tomorrow – then Clubcard data is a very good place to start.

Naturally, it is that dataset that also underpins the Tesco Media & Insight Platform. When combined with the world-leading data science provided by dunnhumby, Clubcard data gives brands and media agencies the opportunity to answer six key questions about shoppers:

- Who – who are the most important customers for my brand and products?

- What – what are they buying today? What are their interests and needs?

- When – when are they shopping? Which days and times? How often?

- Where – where do they shop? Which stores? Online or in person?

- Why – why do they shop as they do? What patterns do they follow?

- How – how do they engage with different media channels?

The answers to these questions help to paint a detailed picture of every shopper – all anonymously, of course. And with that done, it then becomes possible to segment customers into different groups based on shared attributes and characteristics.

Better targeting, better results

Segmentation is critically important to media planning, particularly when it comes to return on advertising spend (ROAS) and other key metrics.

Say that you want to create a sales-focused campaign, for instance. Without knowing specifically which shoppers you want to engage with, you’d be limited either to spreading your budget over a very large audience, or taking some educated guesses and hoping for the best. Segmentations help you focus your spend around those customers most likely to get you the results you want.

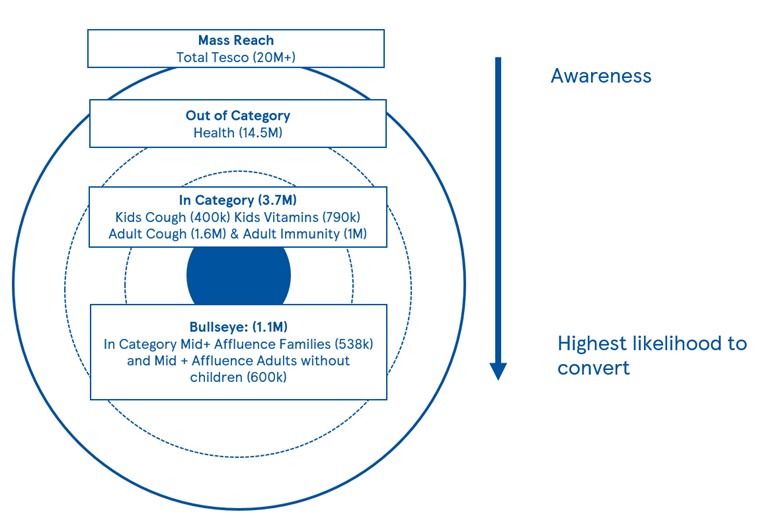

The diagram below helps to bring this to life. In this example, the brand in question is a pharmaceutical company that has a cough medicine within its portfolio of products.

The different rings on the target represent some potential – albeit broad – segmentations:

- Mass Reach – which includes every single Clubcard holder.

- Out of Category – customers who don’t currently purchase any related products.

- In Category – buyers of cough medicines, vitamins, and immunity products.

- Bullseye – “In Category” shoppers, further filtered by affluence and family makeup.

Clearly, the appeal of these different groups is likely to change significantly based on the advertiser’s objective.

Say that pharma company was launching a new cough medicine into the market, for instance; the Mass Reach audience might be a good place to start – though In Category would arguably introduce the product to a greater number of relevant shoppers. In the midst of flu season, on the other hand, with sales being the main focus, the Bullseye audience would almost certainly drive better results.

Regardless of what the ultimate goal is, segmentations can help brands and agencies be more focused when it comes to their media budget. Importantly, that goes far beyond things like purchasing habits, lifestyle, and affluence – with the Tesco Media & Insight Platform providing a way to meet even the most specific objectives.

The right audience for the right need

As well as the segmentations outlined above, the insights provided via the Tesco Clubcard also make it possible to create highly targeted, outcome-focused audiences.

Let’s switch back to the example above. What if the pharma brand wasn’t launching a new product or running a seasonal sales campaign, but instead wanted to create upsell opportunities, grow its presence in a category, or bring back lapsed shoppers? The science that sits behind the Tesco Media & Insight Platform makes that entirely possible through what we call “behavioural” and “predictive” audiences.

These audiences are designed to identify very specific groups of customers that align perfectly with objectives like those above. Under the behavioural banner, for instance, we have:

- Brand Buyers – which focuses on creating upsell and retention opportunities with existing customers.

- Competitor Buyers – where acquiring customers from competing brands is the priority.

- Category Lapsers – for brands that want to win back customers who recently stopped shopping the category.

Over on the predictive side, on the other hand, are the likes of:

- Highly Relevant Buyers – designed to drive sales amongst shoppers of related products.

- Acquisition in Category – which targets people who already shop a category and look likely to switch brands.

- Acquisition out of Category – where the focus is on people who don’t currently shop a category but are likely to start soon.

The power of these audiences is that they give brands and agencies the ability to be incredibly controlled with their media spend. Rather than reaching out to customers who might only “look” right, the science that drives the Tesco Media & Insight Platform makes it possible to find customers whose behaviours truly align with an objective. It’s the perfect combination of huge scale and exact focus.

Ultimately, what that makes for is less wastage and better results. And, perhaps – most importantly of all – it helps to create a better experience for shoppers too, ensuring that the ads they see are truly relevant to them.

Find out how the Tesco Media & Insight Platform can help you Shape What Britain Buys. Get in touch now.